Hey everyone, it’s Thursday, the inbox is restless, and FutureProof is back with more proof that the transition isn’t slowing down, it’s locking in.

This week’s theme is follow-through. Less talk. More execution.

The big three:

Climate action shifts from targets to materials, capital, and deployment.

AI moves out of demo mode and into healthcare, infrastructure, and daily tools.

Clean energy and electrification keep winning on cost, reliability, and scale, even where sceptics said it wouldn’t happen.

Below, coal dips in China and India, net-zero cost scare stories get fact-checked into irrelevance, the Middle East goes hard on renewables, and solar and storage level up again. EVs keep spreading, Chinese manufacturers keep driving prices down, and Europe quietly makes room for more of them.

Plus, two new podcast episodes tackling hard-to-abate sectors and the organisational habits that slow real progress.

FutureProof exists to cut through the noise and track what’s actually changing.

Let’s get into it.

And here are this week’s stories:

Climate

$1.3 Trillion Hiding in Plain Sight: Corporate Climate Cash, Unspent

I’ve lost count of how many times I’ve heard “we need more climate finance” because, awkward detail, a lot of it is already sitting inside company budgets. According to a new analysis, corporates could unlock $1.3 trillion for the energy transition simply by reallocating existing capex.

The highlights

A study of ~1,600 global companies by World Benchmarking Alliance found the median share of capex going to low-carbon projects is just 7%

Lifting that to 30% could free up $1.3 trillion without inventing new funding mechanisms

Only one in four companies reported any low-carbon investment at all, making transparency the real bottleneck

Why This Matters: This isn’t a funding gap problem. It’s a priority problem. The money exists, the tech exists, but too many boards are still treating climate capex as optional rather than strategic.

Kismet: If companies redirected just a slice of routine maintenance capex toward clean upgrades, the unlocked capital would exceed global venture funding for climate tech in every year on record combined. 👉 Full story here

Coal Just Blinked: China and India See Historic Drop

This one matters. A lot. For the first time in 52 years, coal-fired power generation fell simultaneously in both China and India, the two biggest coal users on the planet, and it wasn’t because the lights went out. It was because clean energy finally outran demand.

The highlights

Coal power fell 1.6% in China and 3.0% in India in 2025, the first double decline since 1973

Record additions of solar, wind and nuclear more than covered rising electricity demand

These two power sectors drove 93% of global CO₂ growth over the past decade, making this shift globally decisive

Why This Matters: If this holds, we’re not talking about marginal progress. We’re talking about the conditions for peaking global emissions quietly locking into place.

Kismet: China added more solar capacity in 2025 than the entire world installed in any single year before 2018, and so burned less coal. That’s not symbolism. That’s systemic change. 👉 Full story here

Scary Numbers, Zero Substance: Net-Zero FUD Gets Wrecked

This story is UK-focused, but relevant in all other countries. The same dodgy numbers are being copy-pasted globally to trash the energy transition. A brutal Carbon Brief factcheck shows the so-called “eye-watering costs” of net-zero are mostly context-free nonsense, and that clean energy is still the cheaper, smarter path.

The highlights

Claims of £2tn–£9tn “net-zero bills” collapse once you include fuel savings and avoided climate damage

Many figures are just total energy spending over decades, dishonestly framed as extra costs

Independent analysis consistently finds net-zero is cheaper than sticking with fossil fuels

Why This Matters: This isn’t about Britain. It’s about recognising FUD in the wild. When the numbers sound terrifying, they’re usually hiding the fact that clean energy cuts costs, risk, and volatility.

Kismet: In the UK’s worst energy-price year ever, households spent £265bn on fossil energy without tabloids screaming “national catastrophe”. Apparently wasting money is fine, unless it builds a cleaner, cheaper system. 👉 Full story here

AI News

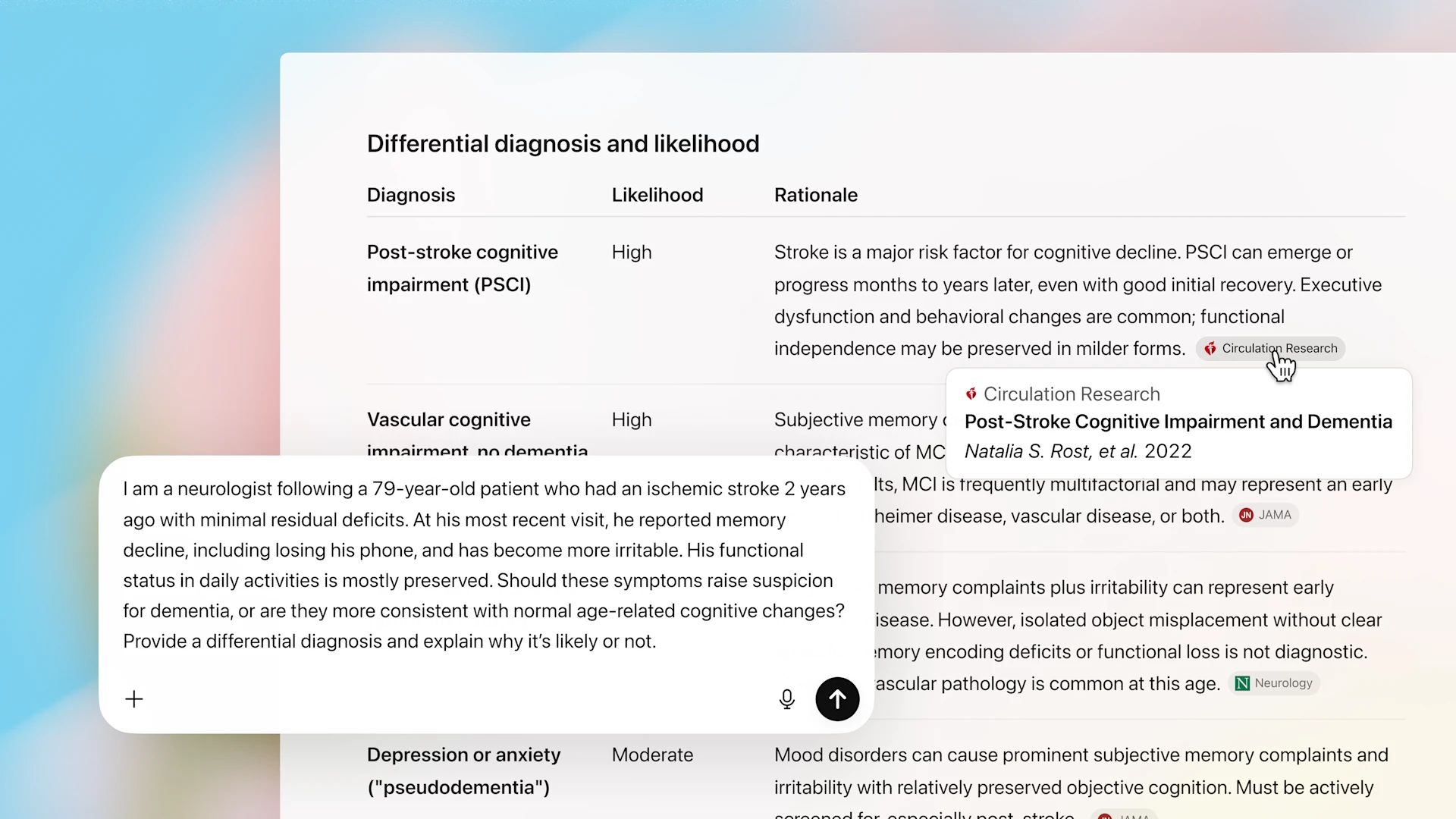

From Paperwork to Precision Medicine: AI’s Healthcare Moment

Three separate announcements this week, one very clear signal: AI has moved from healthcare hype to healthcare infrastructure. From hospitals to labs to gene therapies, the tech is now doing real work, in regulated environments, with actual patients in mind.

The highlights

OpenAI and Anthropic both launched HIPAA-ready healthcare AI, aimed squarely at reducing admin overload, speeding decisions, and grounding outputs in clinical evidence

Hospitals and payers are already using AI to handle prior authorisations, clinical documentation, care coordination, and evidence retrieval, with clinicians staying firmly in charge

Meanwhile, Nvidia and Microsoft backed a breakthrough where AI analysed genomic data from over one million species to design potential new gene therapies and antimicrobial drugs, something that simply wasn’t possible before

Why This Matters: This is AI tackling healthcare’s hardest problems: time scarcity, data overload, and the slow pace of medical discovery. Less clipboard medicine. More capacity to actually care.

Kismet: One of the AI-designed gene-editing tools demonstrated lab success across 10,000+ disease-related locations in the human genome. Evolution ran for 4 billion years. AI just learned to read the notes. 👉 Full stories here, here, and here

Gmail Gets a Brain: Your Inbox Enters the AI Era

If you use Gmail, this one quietly changes everything. Google is rolling out a Gemini-powered overhaul that turns Gmail from a passive message dump into something closer to an active inbox assistant that actually answers questions instead of just hoarding emails

The highlights

Gmail can now summarise long email threads automatically, pulling out decisions, actions, and key facts

You can ask your inbox questions in plain English like “Who sent me that quote last year?” and get a direct answer

AI-driven prioritisation surfaces what matters most, nudging low-value noise out of the way

Why This Matters: Email has been broken for years. This is Google admitting it, and using AI to shift inboxes from chronological chaos to intent-based workflows.

Kismet: With roughly 3 billion Gmail users, even small AI time-savings here add up to one of the biggest productivity upgrades on the planet. Quiet revolution. No new app required. 👉 Full story here

Siri Might Finally Become Useful (No, Really)

You’re not wrong. Siri launched early, then spent a decade confidently misunderstanding us. That might finally change. Apple has announced a rare détente with Google, tapping Gemini to power the next generation of Siri, with Apple insisting privacy stays non-negotiable.

The highlights

Apple will base its next-gen Apple Intelligence and Siri capabilities on Google’s Gemini models

The new Siri is expected later this year, promising far better context, reasoning, and personalisation

Apple says AI processing will still run on-device or via Private Cloud Compute, not as a data free-for-all

Why This Matters: This is Apple quietly admitting Siri fell behind, and doing the most Apple thing possible: borrowing best-in-class AI while wrapping it in privacy theatre that users actually care about.

Kismet: Siri debuted in 2011, before WhatsApp voice notes, before TikTok, before the term “AI assistant” meant anything useful. If this works, Siri’s comeback arc may be one of tech’s longest overdue glow-ups. 👉 Full story here

Electromobility

“EVs Are the End Game” – Even Detroit Knows It

This was a refreshingly blunt moment from the heart of legacy auto. Despite regulatory whiplash and a very public EV slowdown, Mary Barra stood her ground and said the quiet part out loud: EVs are still the destination.

The highlights

General Motors had a record EV sales year in 2025, even as US demand cooled after US tax credits were pulled

Barra pointed out that once someone buys an EV, they’re 80% more likely to buy another, a loyalty stat legacy carmakers would kill for

GM may add hybrids tactically, but Barra was clear: they’re bridges, not the finish line

Why This Matters: When the CEO of one of the world’s biggest carmakers says EVs are inevitable, even while scaling back in the short term, that’s not ideology. That’s industrial realism.

Kismet: GM took a $6bn hit from slowing its EV rollout. And still Barra says EVs are the end game. That’s what conviction looks like when the spreadsheets get uncomfortable. 👉 Full story here

Europe’s EV Market Just Got More Competitive

This one’s big for European drivers. China and the European Union have agreed a framework to defuse their trade spat over Chinese-made EVs, clearing a path for more affordable electric cars to land in Europe without the tariff war dragging on.

The highlights

The EU will allow Chinese EV makers to continue exports under minimum price commitments, instead of blanket tariffs of up to 35%

Chinese manufacturers may also factor in EU-based investment plans, nudging local production and supply chains

Analysts expect Chinese brands to keep gaining market share in Europe, potentially doubling to ~10% by 2030

Why This Matters: Europe needs EVs at scale, fast. More competition means lower prices, faster adoption, and less patience for legacy carmakers still dragging their heels.

Kismet: Chinese-made cars already account for 6% of EU sales, up from 5% a year earlier. The real disruption isn’t tariffs. It’s what happens when €19k EVs become normal. 👉 Full story here

China’s EV Engine Isn’t Stalling. It’s Changing Gear.

China had a monster 2025 for EVs, at home and abroad. Now comes the cautious forecasting for 2026, with some analysts warning of flat sales and fading export momentum. Fair. Sensible. Also… probably incomplete.

The highlights

China’s overall car sales are forecast to be flat in 2026, after growing 3.9% in 2025, with domestic demand cooling as subsidies taper

EV exports surged nearly 50% in 2025, but industry bodies expect that growth rate to slow as global markets normalise

What many forecasts don’t fully price in: the new European Union–China EV trade framework, falling battery costs, and a fresh wave of cheaper, better models

Why This Matters: Yes, growth rates will wobble. That’s what happens when EVs move from niche to mainstream. But with prices still falling, technology improving, and Europe reopening the door, the direction of travel is clear. Slower growth is not reversal. It’s maturation.

Kismet: Even in a “cooling” year, new energy vehicles made up nearly 60% of all car sales in China by the end of 2025. When your worst-case scenario is most cars already being electric, the boom hasn’t ended. It’s spread. 👉 Full story here

Clean Energy

Wait, the Middle East Is Going Green?

Yes. Genuinely yes. A new outlook suggests the Middle East and North Africa could see one of the fastest renewable energy expansions on the planet, driven less by climate altruism and more by cold, hard economics.

The highlights

Variable renewables capacity in the region is projected to grow ~10× by 2040, according to DNV

By 2060, solar and wind could supply ~85% of electricity, with solar alone contributing around 45%

The Masdar portfolio has already hit 65 GW, with a clear line of sight to 100 GW by 2030

Why This Matters: When some of the world’s biggest hydrocarbon exporters pivot this hard toward renewables, it’s a signal that clean power has won on cost, competitiveness, and energy security, not just climate narratives.

Kismet: The same region that perfected oil economics is now scaling solar so cheaply that renewables are becoming the default power source for future hydrogen production. When even petro-states are planning for a post-oil grid, the transition argument is over. 👉 Full story here

Solar, But Make It Better: Perovskites Are Nearly Here

If you think solar is already cheap, fast, and disruptive, wait. Tandem perovskite-silicon solar cells are edging out of the lab and toward mass production, promising another step-change in efficiency and cost that makes today’s panels look… quaint.

The highlights

Tandem perovskite-silicon cells are already hitting ~29–30% efficiency, roughly 30% better than standard silicon panels

Higher efficiency means less land, lower balance-of-system costs, and cheaper electricity overall

Durability breakthroughs and serious private investment signal this is no longer “five years away” tech

Why This Matters: Solar didn’t just win because it was clean. It won because it kept getting better. Perovskites extend that curve, pushing costs down again just as global electricity demand surges.

Kismet: Perovskites were once dismissed as too fragile for the real world. Now they’re being stress-tested for utility-scale deployment in deserts. That’s usually the last stop before something eats an entire industry.

And yes, if you want to go deeper, I’ve covered perovskite solar in a couple of episodes of the Climate Confident podcast. Consider this your nudge to nerd out.

👉 Full story here

Battery Storage

Batteries Are Getting Cheaper. Again. And This Time It’s Sodium.

Just when lithium-ion looked unbeatable, along comes another quiet upgrade to the energy transition’s engine room. Sodium-ion batteries are now brushing up against cost parity with lithium-ion, and the scary bit for incumbents is that this is only the beginning.

The highlights

New research led by LUT University finds sodium-ion cells are already near lithium-ion costs today

By 2050, sodium-ion storage could hit €11–14/MWh, undercutting lithium-ion’s projected €16–22/MWh

Sodium-ion avoids lithium, cobalt, and nickel supply risks, works across wider temperature ranges, and can be made on existing battery production lines

Why This Matters: Grid-scale storage is already reshaping power systems. Cheaper, cleaner, more abundant batteries mean renewables scale faster, grids get more resilient, and crucially fossil peaker plants lose their last lame excuse.

Kismet: The study suggests batteries are no longer the limiting factor in the global energy transition. When storage stops being the bottleneck, the only thing left slowing clean energy is politics. 👉 Full story here

Podcasts

Climate Confident:

This Week on Climate Confident: Cement, Carbon, and a Radical Rethink of How We Build

Concrete isn’t just boring grey stuff. It’s responsible for 8% of global emissions, and unlike power or transport, demand is still rising. In this week’s Climate Confident, I sat down with Ana Luisa Vaz, VP of Product at Paebbl, to talk about a genuinely different approach: locking CO₂ into concrete itself.

What we covered

Why cement is so hard to decarbonise and why electrification alone won’t solve it

How Paebbl uses accelerated mineralisation to permanently store CO₂ inside construction materials

Why conservative industries can still change when performance, safety, and cost line up

Why This Matters: Construction isn’t shrinking, so emissions cuts have to come from materials innovation, not wishful thinking. If concrete can become low-carbon or even carbon-negative, one of the toughest sectors finally moves.

Kismet: Cement chemistry hasn’t fundamentally changed in over 100 years. Paebbl’s approach compresses a natural geological process that normally takes millions of years into something fast enough for modern construction. That’s not incremental. That’s a reset. 🎧 Listen to the full episode

Resilient Supply Chain:

This Week on Resilient Supply Chain: Why Data, Not AI, Is Your Biggest Risk

Everyone’s talking about AI saving supply chains. This episode is a necessary cold shower. I sat down with Catryna Jackson and Monique Parker to unpack why most resilience failures aren’t technical at all. They’re organisational.

What we covered

Why EHS, sustainability, and supply chain still operate in silos and why that’s a risk multiplier

How climate risks are already showing up as safety, operational, and financial risks

Why “just add AI” won’t fix broken data, poor engagement, or supplier relationships

Why This Matters: Resilience isn’t about dashboards. It’s about decision architecture, shared language, and real engagement across the supply chain. Get that wrong and no amount of AI will save you.

Kismet: Over 75% of ESG reporting pain sits in the supply chain, yet most companies still treat suppliers as an afterthought. If resilience keeps failing, it’s not because leaders lack tools. It’s because they’re looking in the wrong place. 🎧 Listen to the full episode

Coming Soon to the podcasts

In the coming episodes I will be talking to Dr Nisha Kohli, Founder and CEO of Corpstage, and Rob Stait, MD of Alight BtM.

Don’t forget to follow the podcasts in your podcast app of choice to ensure you don’t miss any episodes.

Featured Chart(s)

ERCOT is the Texas electricity grid operator - and from its data you can see all the growth in the last few years is renewables (wind and solar). In Texas. Home of Dallas and Houston. Because economics.

This is the cumulative emissions of the top emitting countries since 1850. You hear a lot in the media about how China is the top emitting country in the world, and that is true right now, but when total emissions is taken into account, the US is by far the biggest emitter. And if you then factor in the population of the US being around 350 million vs China’s 1,100 million, per capita the US’ emissions are off the charts.

Misc stuff

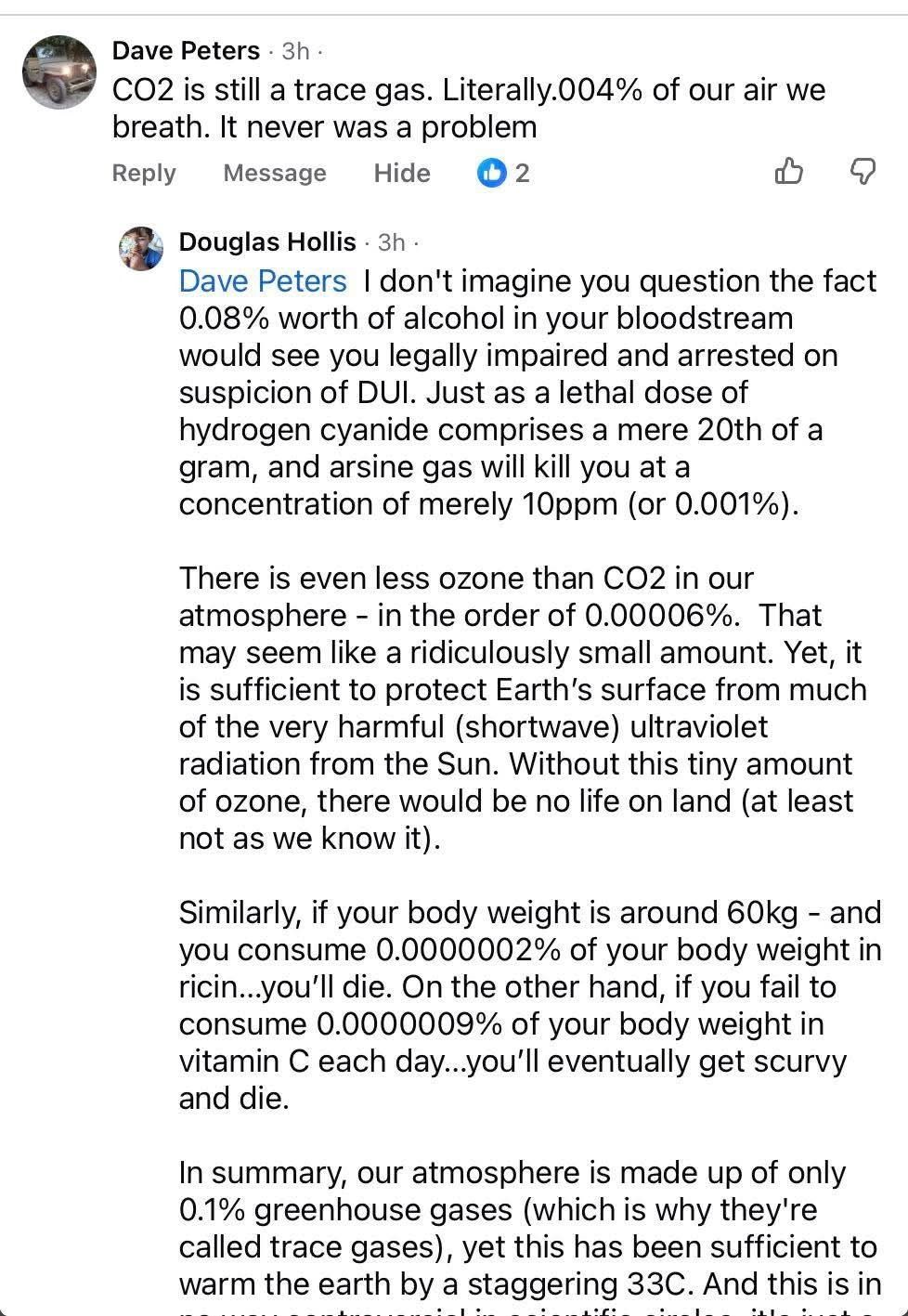

If you hear people saying CO2 couldn’t be causing climate change as it only comprises 0.04% of the air we breathe, some handy data above to slap down that idiocy!

Correlation ≠ causation

When you work in an Apple Store and enjoy internet memes!

Engage

If you made it this far, very well done! If you liked this newsletter, or learned something new, feel free to share this newsletter with family and friends. Encourage folks to sign up for it.

Finally, since being impacted by the tech layoffs, I'm currently in the market for a new role. If you know someone who could benefit from my tech savvy, sustainability, and strong social media expertise, I'd be really grateful for a referral.

If you have any comments or suggestions for how I can improve this newsletter, don’t hesitate to let me know. Thanks.

*** Be aware that any typos you find in this newsletter are tests to see who is paying attention! ***

And Finally

A big 2026 starts now

Most people treat this stretch of the year as dead time. But builders like you know it’s actually prime time. And with beehiiv powering your content, world domination is truly in sight.

On beehiiv, you can launch your website in minutes with the AI Web Builder, publish a professional newsletter with ease, and even tap into huge earnings with the beehiiv Ad Network. It’s everything you need to create, grow, and monetize in one place.

In fact, we’re so hyped about what you’ll create, we’re giving you 30% off your first three months with code BIG30. So forget about taking a break. It’s time for a break-through.